Retirement Planning

Retirement Planning

When will you retire?

As soon as possible

As late as possible

When to retire?

This is when you plan to stop working entirely, or enter a new phase of your work life where you choose to work part time or in a different capacity.

- Retirement Needs

- Basic Needs

- Housing Costs:- Rent or mortgage, utilities, insurance, taxes, fees, or property maintenance.

- Health Care Costs:- Medicine, insurance premiums & co-payments.

- Transportation Costs:- Automobile maintenance costs, insurance & repairs, public transportation.

- Living Expenses:- Food & clothing

Which of the following will be the primary source(s) of income for you to pay for basic retirement expenses:-

- Social Security

- Pension

- Guaranteed income investments such as an annuity

- Personal Savings

- Reverse Mortgage

- Part-time/Full-time work

- Property

- Dependent on other or charity

1) Stay where I am

2) Live in a more comfortable climate

3) Live in a gated community

4) Move to a more affordable area

5) Live in the country

6) Downsize

7) Live near the water

8) Low maintenance home

9) Move to an area with lower taxes

10) Live on a resort

11) Live in a city

LOW

HIGH

1) Pursuing my creative interests

2) Shopping for art, antiques or other collectibles

3) Working around my home or in the garden

4) Recreational activities

5) Working part time

6) Volunteering on behalf of organizations

7) Enjoying cultural activities like concerts & shows

8) Spending time relaxing with families

9) Staying in shape by exercising or going to the gym.

10) Upgrading the interior or exterior of my home.

11) Attending sporting events

12) Spending time relaxing with friends

13) Travelling locally or regionally

14) Travelling Internationally

15) Cooking at home with favourite recipes

16) Reading my favourite books, blogs or magazines

17) Managing my investments

18) Spending time in a second residence

19) Going back to school to study or learn new skill

20) Spending time or playing grandson or granddaughter

21) Contributing for the masses

Important Retirement Activities

- Pursuing my creative interests

- Volunteering on behalf of organizations

- Enjoying cultural activities

- Recreational activities

a) Social Security

b) Pension

c) Guaranteed income investments, such as annuity

d) Personal Savings

e) Reverse Mortgage

f) Part time/full time work

Risks RetirementLongevity Investment Inflation Health Care & Long Term Care Public Policy Other

Knowing what risks you may encounter is the first step in identifying solutions that help ensure your goals are achieved.

Everyone wants to live long, healthy life. How can this be a bad thing?

The longer you live, you become exposed to several risks, such as:-

1 Depleted savings causing you to reduce your standard of living.

2 Have increased medical expenses.

3 Lose purchasing power to inflation.

4 Require long term care.

5 Experience the death of spouse.

Do you come from a family with long life expectancies?

Do (or did) any of your family members require long-term care?

Are you planning for a retirement that could last for more than 20 years?

LOW

HIGH

Investment Risk is the risk that your investment may perform worse than expected. Market risk is the risk the value of an investment will fluctuate, resulting in lower than expected returns. Interest rate risk is the risk that returns on fixed-rate investments, such as certificates of deposit (CDs), will be lower in the future.

How would you describe your comfort level with investment risk?

1) Conservative – Prefer guarantees

2) Moderate – Prefer a balance of guarantees & some risks

3) Aggressive – Prefer risks fit means a possibility of greater returns.

LOW

HIGH

Inflation is especially dangerous for those who are retired, an retired people depend more on income sources that are not adjusted for inflation.

The prices of health care & medicine & other goods & services most used by retires, have historically increased faster than the inflation rate.

i) Do you have sources of retirement income other than social security that automatically increase with the cost of living?

ii) Have you accounted for inflation risk when planning your retirement?

LOW

HIGH

The medical advances & new prescription drugs that improve & extend lives can be a major expense.

More than half of Indian population will require some type of long-term care during their lives.

1) Do you plan to purchase insurance to supplement medicine?

2) Do you have health care coverage until age 65, 70, 75, 80?

3) Have you considered the costs associated with chronic illness?

4) Have you considered the cost of prescriptions in retirement?

5) Have you planned for the possibility that you will require long-term care?

Where would you prefer to receive care?

(1) at home, (2) adult day care centre, (3) assisted living facility, (4) nursing home

LOW

HIGH

Your retirement will experience the effects of public policies that you have little individual control over, such an increases in taxes, changes in medicare benefits, changes in interests.

1) Does your current retirement planning fully minimize the impact of taxes?

2) Are you concerned that your government – provided retirement benefits may be reduced?

LOW

HIGH

Employment Risks – the option to continue to work or work part-time in retirement is dependent upon an available job & your health.

Loss of spouse risk – pensions, social security benefits, health insurance & other benefits may be reduced at the death of the spouse. The loss of a spouse may make it difficult to manage finances.

Caregiver Risks – who will care of your, if needed? Who will rely on you for care? The financial costs of providing for an outside caregiver, or the strain on a family member must be considered.

1) Do you plan to work during retirement?

2) Will you continue to rely on your employer for pension benefits or health insurance?

3) Will either of you be able to maintain your standard of living after loss of your spouse?

4) Will a family member need to be your caregiver?

LOW

HIGH

1. Maintain the standard of living that we are accustomed to

2. Enable us to do things that we could not during our working days

3. Preserve our dignity by being independent

4. Provide our contingencies

5. Support those we care about (can we helplessly watch our dear ones struggle?)

6. Retire early

1. Lack of planning

2. Hesitation to consult a financial professional

3. Wrong prioritisation like taking house loan with a huge EMI at a young age

4. Spending more money during the period of active work life and saving less

5. Unexpected expenses at middle age

6. Inadequate insurance

7. Consuming the retirement fund for other interim needs.

So, are we prepared to live long? Yes, most of us want to live long life. Are we prepared for it? To be financially stable even in those golden years we have to start planning very early in life.

1. Replacement Ratio Method: is an estimate of a certain percentage of the active income at the time of retirement that will continue post retirement.

2. Expenses Provision Method: we assess the likely expenses post retirement and estimate the corpus required to meet that, and then plan how much contribution is required from Mr X from now to build that corpus.

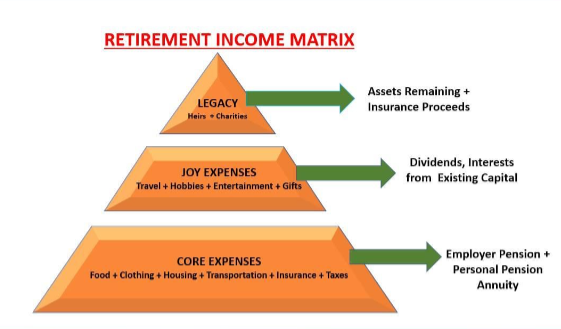

Step 1 – Envision: the first step entails getting a deeper understanding of what clients’ issues are, both currently and for retirement. Once we understand where a client wants to go in terms of their vision and goals, we separate the goals that relate to Core, Joy and Legacy Expenses. Subsequently we match these expenses to the client’s income and assets.

Step 2 – Analyze: We help the client to literally “see” a vision of their retirement lifestyle.

Step 3 – Solutions: In the third step we recommend financial solutions and strategies.

Step 4 – Evaluate: No matter how good a financial plan is , it should be reviewed on a regular basis.