LIC

LIC

Life Insurance Corporation of India (abbreviated as LIC) is an Indian statutory insurance and investment corporation. It is under the ownership of the Ministry of Finance,Government of India.

The Life insurance Corporation of India was established on 1 September 1956, when the Parliament of India passed the Life Insurance of India Act that nationalized the insurance industry in India. Over 245 insurance companies and provident societies were merged to create the state-owned Life Insurance Corporation of India.

As of 2019, Life Insurance Corporation of India had a total life fund of ₹28.3 trillion. The total value of sold policies in the year 2018–19 is ₹21.4 million. Life Insurance Corporation of India settled 26 million claims in 2018–19. It has 290 million policyholders.

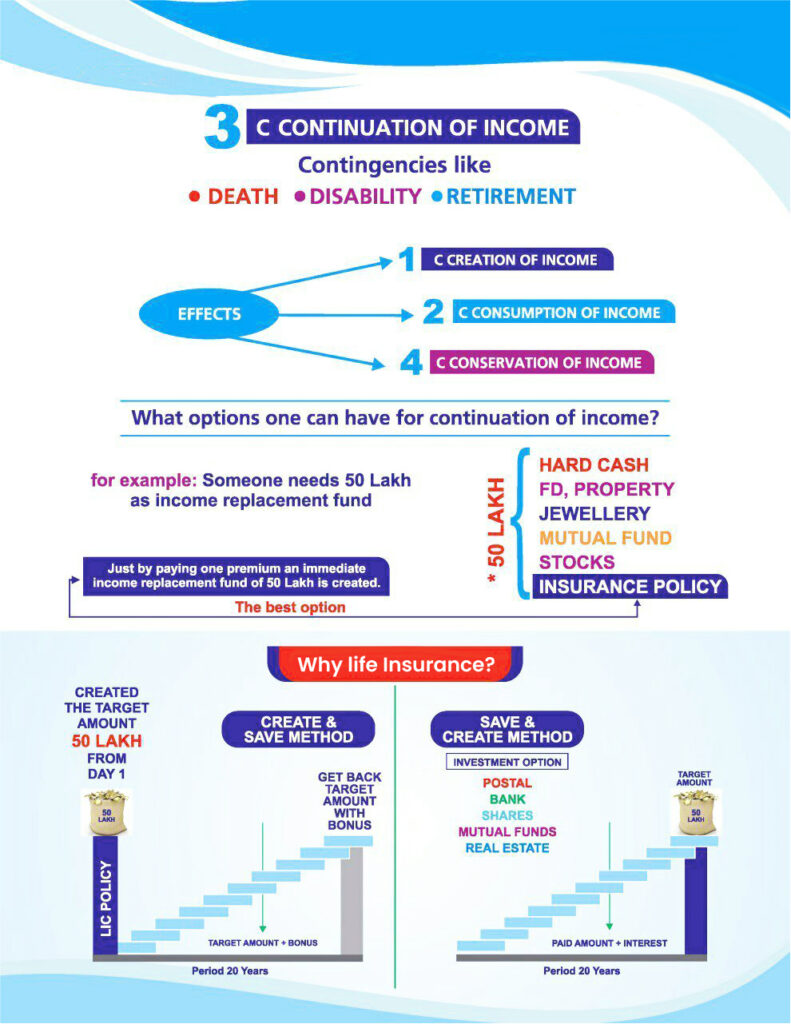

Life insurance is a contract that pledges payment of an amount to the person assured (or his nominee) on the happening of the event insured against Unfortunate death, if it occurs earlier. Among other things, the contract also provides for the payment of premium periodically to the Corporation by the policyholder.

Total Asset – 38 lakh crore

Income – 27 lakh crore

Life Fund – 28.3 trillion

Surplus – 56,406 crore

Largest in the world = 40 crores policy holders

29.09 CRORES INDIVIDUAL POLICYHOLDER

11.61 CRORES GROUP LIVES

LIC Agent is the person who provides advice on Life Insurance Planning to people to protect their family from unexpected events of death, disability and retirement of the breadwinner.