Life Insurance: Safeguarding SMB Success

Small and medium-sized business establishments, often lovingly referred to as the heartbeat of local economies, embody the spirit of entrepreneurship and innovation. These enterprises, brimming with passion and determination, serve as the lifeblood of communities, weaving together the fabric of economic prosperity and opportunity.

The exact criteria for what constitute a small or medium-sized business can vary by country and industry, but they generally fall within the following parameters:

- Micro-enterprises: These are the smallest category of businesses, typically defined as having fewer than 10 employees. Micro-enterprises often operate on a very small scale, sometimes with just one or two individuals running the business.

- Small enterprises: Small businesses usually have between 10 and 50 employees. They are larger than micro-enterprises but still relatively small in scale compared to larger corporations. Small enterprises may have more established operations and may offer a broader range of products or services.

- Medium-sized enterprises: Medium-sized businesses typically have between 50 and 250 employees. These companies are larger and more complex than small businesses, often with more formalized organizational structures and processes. They may also have a more significant impact on their respective industries and local economies.

Small and medium-sized business enterprises play a crucial role in economies around the world. They are often seen as engines of innovation, job creation, and economic growth. SMBEs are known for their agility and ability to adapt quickly to changing market conditions, making them an important component of vibrant and dynamic business ecosystems.

Let’s delve into the intricacies of these characteristics of small and medium-sized business establishments (SMBEs) with clarity and depth:

- First Generation: SMBEs often trace their origins back to the vision and hard work of their founders, representing the entrepreneurial spirit at its inception. These businesses are typically founded by individuals or families with a pioneering zeal to bring their ideas to life and make a mark in their chosen industry.

- Closely Held: SMBEs are often closely held by the founding family or a small group of individuals, fostering a sense of intimacy and shared ownership among stakeholders. This closeness can contribute to a strong sense of identity and purpose within the organization.

- Dependence of Sorts of Few: In many SMBEs, decision-making power may be concentrated in the hands of a select few individuals, such as the founders or key executives. This can lead to a higher degree of dependence on their expertise and leadership, shaping the direction and strategies of the business.

- Expertise in Core Area but Less Exposed to Financial, Legal, Corporate, Risk Management, etc. Aspects: SMBE founders and managers often excel in their core business areas, such as product development or service delivery, but may have limited exposure to other critical functions like finance, legal compliance, corporate governance, and risk management. This knowledge gap can pose challenges in navigating complex regulatory environments and mitigating business risks effectively.

- No Difference Between Business Accounts and Personal Accounts: In some SMBEs, especially those closely held by families or individuals, there may be a blurred distinction between business and personal finances. This lack of separation can lead to challenges in financial management, tax compliance, and accessing capital for business growth.

6.Bank Loans (Secured): SMBEs often rely on bank loans as a primary source of external funding for expansion or working capital needs. These loans are typically secured against assets owned by the business, providing lenders with collateral in case of default.

- Private Loans (Unsecured): In addition to traditional bank financing, SMBEs may also seek private loans from individuals or non-bank financial institutions. These loans may be unsecured, meaning they are not backed by specific assets, and often involve higher interest rates or alternative lending terms.

- 8. Children May/May Not Join: In family-owned SMBEs, the decision of whether children will join the business is often a complex and deeply personal one. While some children may feel a strong desire to carry on the family legacy and contribute to the business, others may pursue different career paths or entrepreneurial ventures outside the family business.

- 9. External Threats Like Regulatory Changes, Big Business Houses Competing, Market Changes, etc.: SMBEs face a myriad of external threats that can impact their viability and competitiveness. These threats may include regulatory changes, increased competition from larger corporations, shifts in consumer preferences, economic downturns, and technological disruptions. Navigating these challenges requires agility, adaptability, and strategic foresight.

- Thrill and Stress: Running an SMBE can be both exhilarating and stressful for entrepreneurs and managers. The thrill of building something from the ground up, seeing ideas come to fruition, and making a positive impact on customers and communities can be deeply rewarding. However, the pressure of managing day-to-day operations, meeting financial obligations, overcoming obstacles, and staying ahead of competitors can also take a toll on individuals and their families.

Overall, SMBEs are dynamic entities that embody the spirit of enterprise, resilience, and aspiration. While they face numerous challenges and uncertainties, they also represent a vital engine of economic growth, innovation, and job creation in communities around the world.

Risk management is crucial for the success and sustainability of small and medium-sized business enterprises (SMBEs). Here’s how SMBEs can effectively manage risks:

- Identify Risks: SMBEs should conduct thorough risk assessments to identify potential risks that could affect their operations, finances, reputation, and stakeholders. This process involves identifying internal and external risks, such as market fluctuations, regulatory changes, cybersecurity threats, operational vulnerabilities, and financial uncertainties.

- Assess Risks: Once risks are identified, SMBEs should assess their potential impact and likelihood of occurrence. This assessment helps prioritize risks based on their severity and likelihood, allowing businesses to focus on addressing high-priority risks that pose the greatest threat to their objectives and success.

- Develop Risk Management Strategies: SMBEs should develop comprehensive risk management strategies to mitigate, transfer, or accept identified risks. This may involve implementing risk mitigation measures, such as enhancing cybersecurity protocols, diversifying revenue streams, obtaining insurance coverage, establishing emergency funds, or implementing internal controls and compliance procedures

By proactively identifying, assessing, and managing risks, SMBEs can enhance their ability to navigate uncertainties, seize opportunities, and achieve their business objectives in a rapidly evolving business landscape.

Life insurance can play a crucial role in the risk management strategy of small and medium-sized business enterprises (SMBEs) in several ways:

- Key Person Insurance: SMBEs often rely heavily on key individuals whose knowledge, expertise, or relationships are essential to the success of the business. Key person insurance provides financial protection to the business in the event of the death or disability of a key employee or owner. The proceeds from the policy can help cover recruitment and training costs for a replacement, offset lost profits, repay debts, or provide liquidity to buy out the deceased owner’s share of the business.

- Buy-Sell Agreement Funding: In family-owned or closely held SMBEs, a buy-sell agreement outlines what will happen to an owner’s share of the business if they die or become incapacitated. Life insurance can be used to fund a buy-sell agreement, ensuring that surviving owners have the funds necessary to buy out the deceased owner’s share at a predetermined price. This helps facilitate a smooth transition of ownership and provides financial security to the deceased owner’s family.

- Loan Protection: SMBEs often rely on loans or lines of credit to finance their operations, investments, or expansion projects. Life insurance can be used to provide collateral or guarantee for business loans, ensuring that outstanding debts are repaid in the event of the death or disability of the business owner or key individuals involved in the loan agreement.

- Employee Benefits: Offering life insurance as part of employee benefits packages can help SMBEs attract and retain talented employees. Group life insurance policies provide financial protection to employees’ families in the event of their death, offering peace of mind and financial security to employees while enhancing their loyalty and commitment to the business.

- Estate Planning: Life insurance can be a valuable tool for estate planning purposes, especially for SMBE owners who wish to pass on their business to future generations. Life insurance proceeds can be used to pay estate taxes, settle outstanding debts, or provide an inheritance to family members who are not involved in the business, ensuring a smooth transition of wealth and assets.

- Business Continuity Planning: Life insurance can be integrated into SMBEs’ broader business continuity and succession planning efforts. By ensuring that adequate financial resources are available to the business in the event of unexpected events like the death or disability of key individuals, life insurance helps safeguard the continuity and long-term viability of the business.

Overall, life insurance serves as a critical component of SMBEs’ risk management strategies, providing financial protection, stability, and peace of mind to business owners, employees, and stakeholders alike. It helps mitigate the financial risks associated with unforeseen events, ensuring that SMBEs can continue to thrive and grow in an increasingly dynamic and competitive business environment.

Allow me to elucidate the profound connection between risk management and the profitability of a Small and Medium Business Establishment (SMBE), underscoring why effective risk management is paramount for the growth and development of such enterprises.

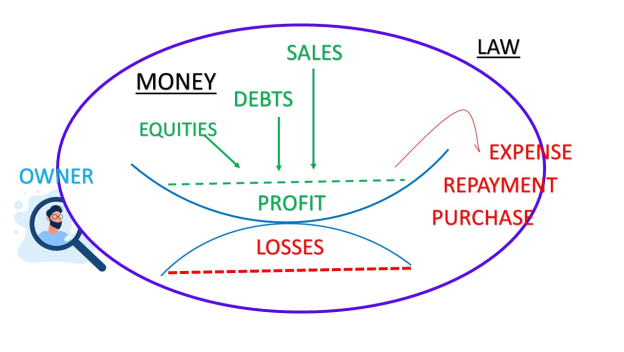

Every business, irrespective of its scale, must navigate within the framework of laws and regulations set forth by the governing authorities. Whether it operates as a partnership or a public limited company, compliance with relevant statutes is imperative. For instance, a partnership firm adheres to the Partnership Act, while a public limited company abides by the regulations stipulated for such entities. Furthermore, factors like the number of employees trigger additional legal obligations, such as adherence to Provident Fund and Gratuity Acts.

In the pursuit of sustainable operations, businesses require financial resources sourced from various channels—equity, debt, and revenue generated through sales. Among these, revenue from sales stands out as a vital artery, capable of infusing unlimited capital into the business. Consequently, enterprises prioritize sales as a cornerstone of their financial strategy. However, alongside revenue generation, prudent management of expenses, debt servicing, and procurement is indispensable. A delicate balance must be struck between income and outflow, with profitability being the ultimate objective.

It is here that the expertise of risk management and financial professionals becomes indispensable for SMBE owners. Through astute financial forecasting and risk mitigation strategies, these experts empower business owners to augment profits while minimizing potential losses. Their guidance not only enhances the financial resilience of SMBEs but also fosters a trajectory of sustainable growth and prosperity.

In essence, the symbiotic relationship between risk management and profitability underscores the pivotal role played by strategic foresight and financial acumen in the trajectory of SMBE development.

Adam Smith, best known for his seminal work “The Wealth of Nations,” famously described the concept of the “invisible hand,” suggesting that the pursuit of self-interest by individuals can unintentionally promote the greater good of society. In the context of risk management, this implies that decentralized decision-making in response to risk can lead to more efficient outcomes compared to centralized control, as individuals such as professional advisors are often best positioned to assess and manage risks for small and medium-sized businesses (SMBEs).