Mortality Credits

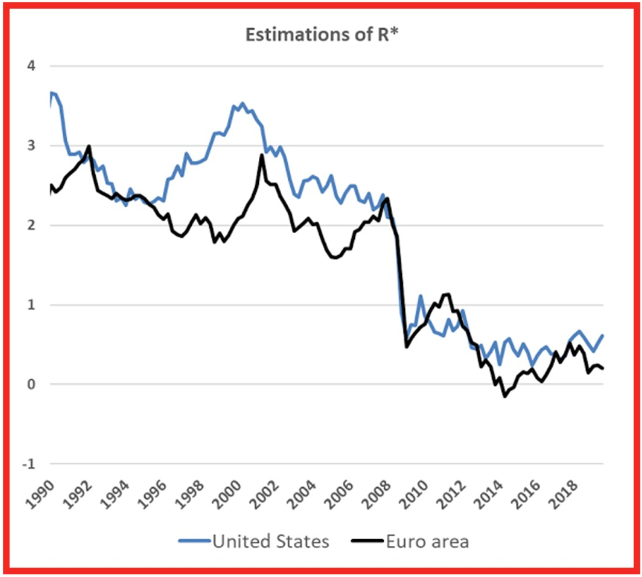

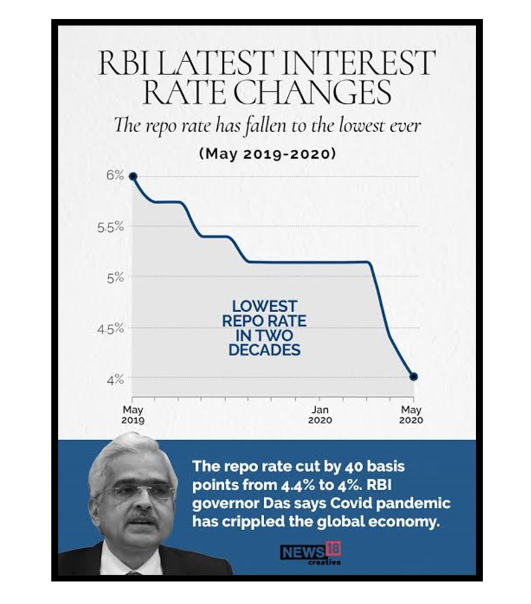

The front page article of the April 4, 2011 Wall Street Journal-

“Fed’s Low Interest Rates Crack Retiree’s Nest Egg.”

The article focused on a gentleman by the name

Mr. Forrest Yeager, a 91 year old resident of Florida.

“Americans who have done everything right, have worked hard, saved their money and stayed out of debt are the ones being punished by low interest rates.”– says Mr. Richard Fisher, President of the Federal Reserve Bank of Dallas

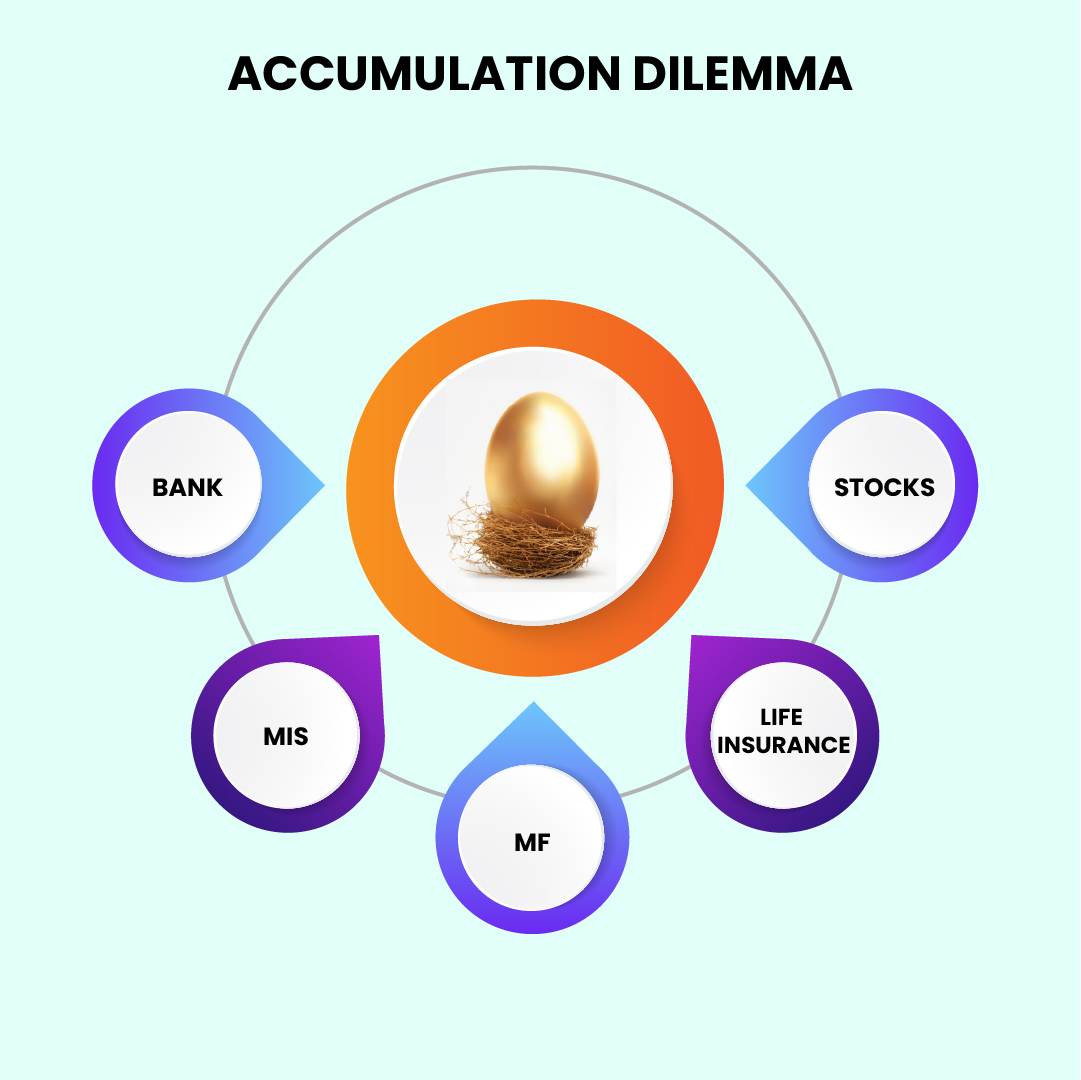

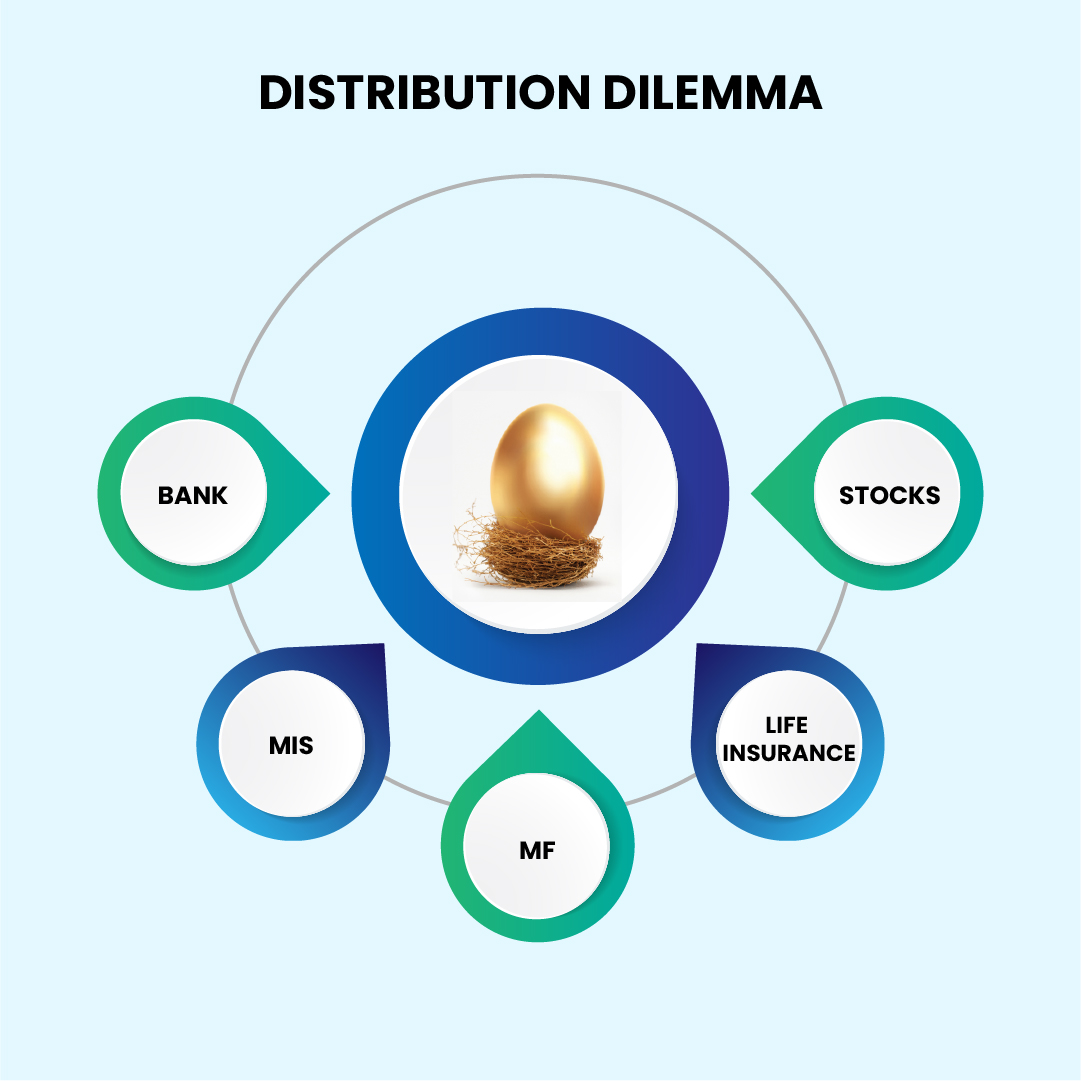

Advisors may offer you

- Any Major MF

- Money Market Investment

- Tax Free Bond

- High Dividend Paying Stocks

- Why settle for a boring old “Lifetime Income Annuity” when you could buy bonds or stocks instead?

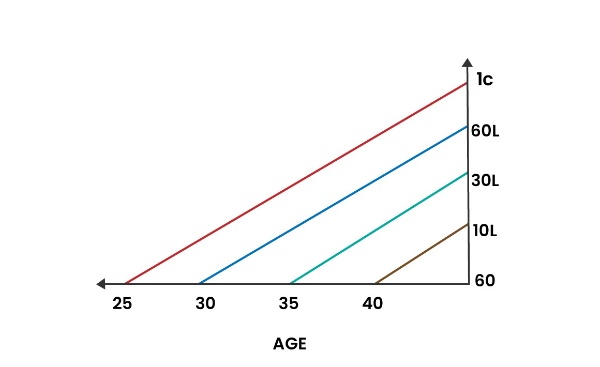

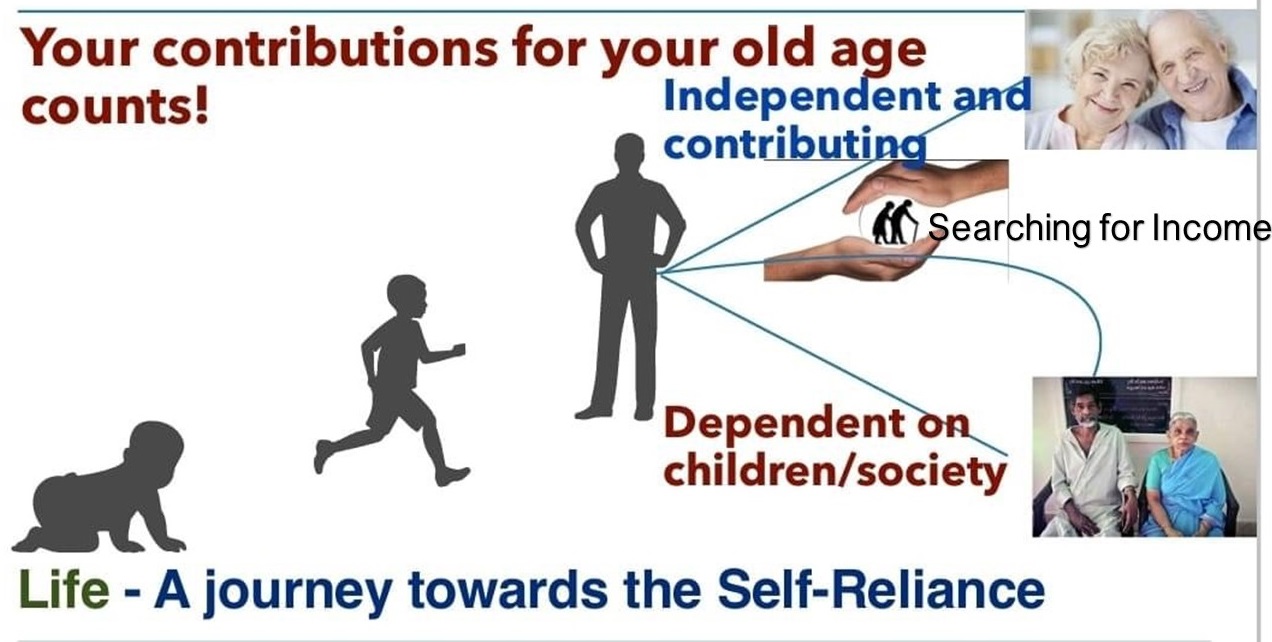

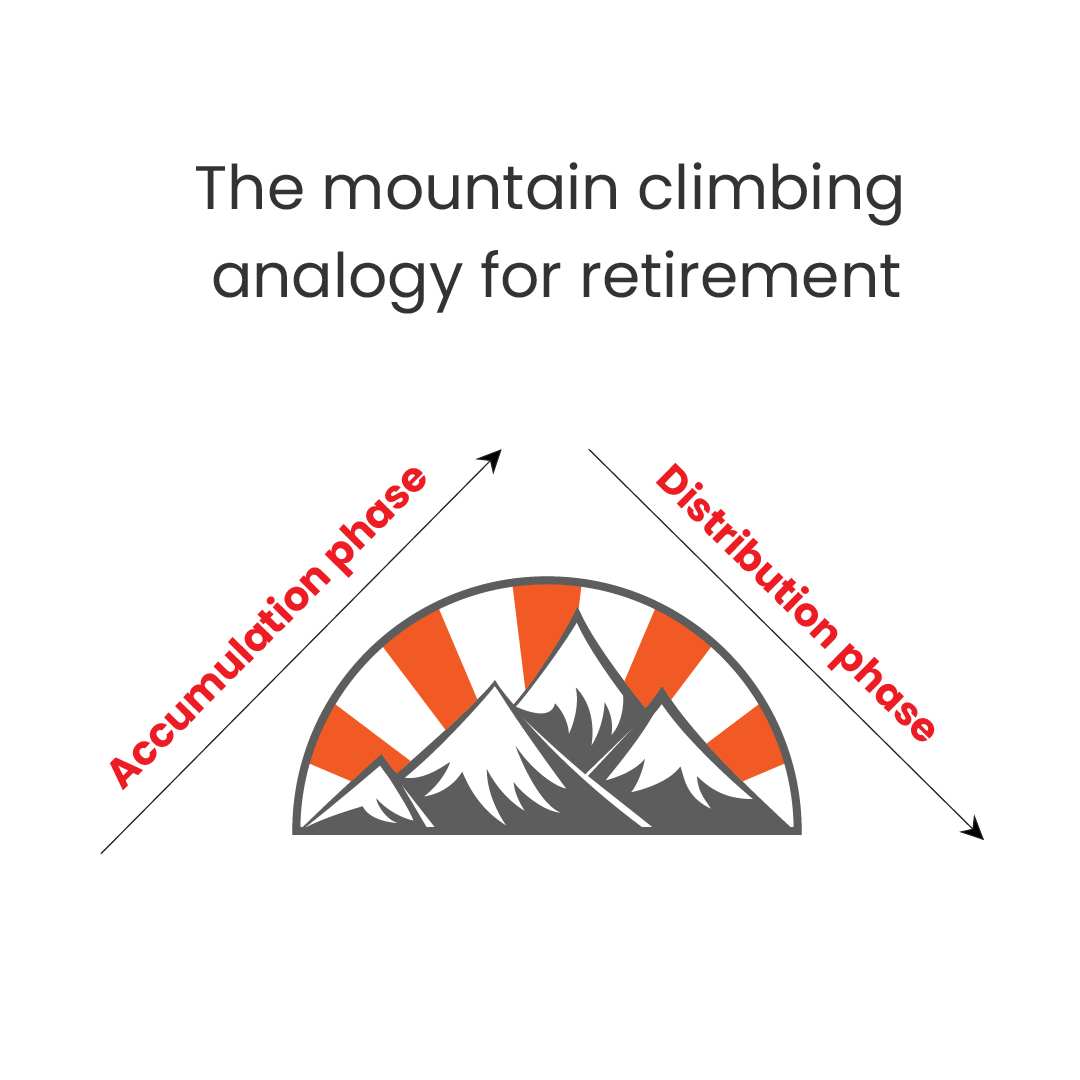

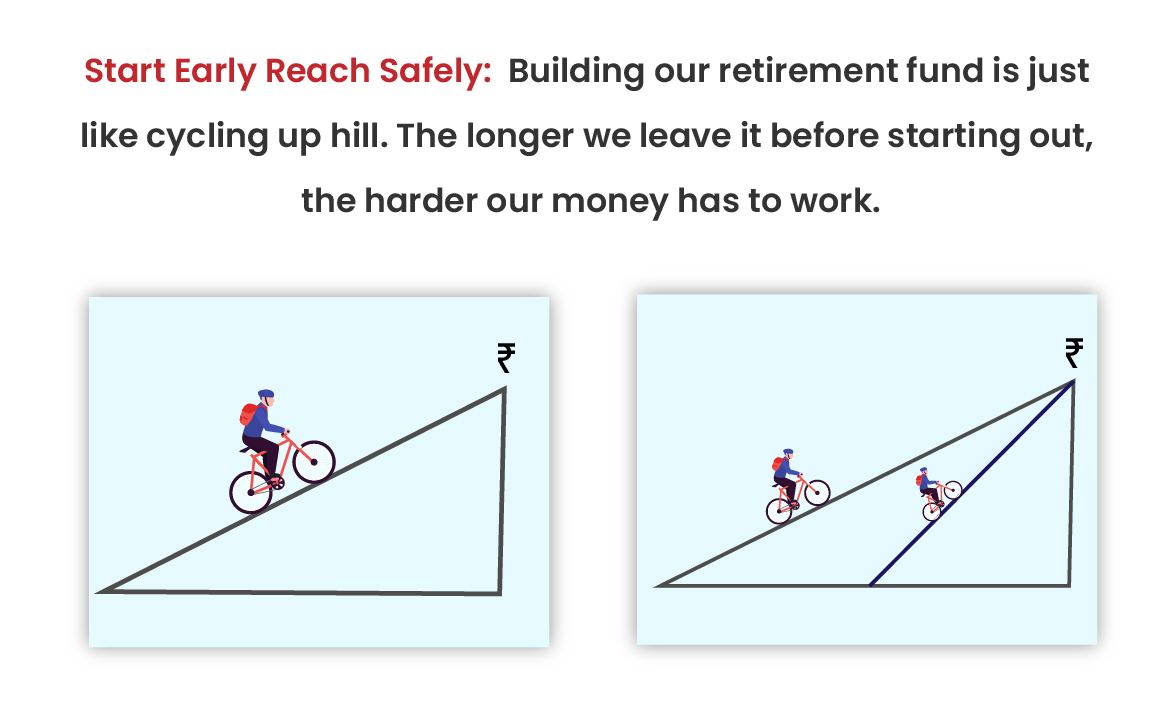

Accumulating money is an important first step on the road to Retirement

“Start Early & Reach Safely.”

| Assets | Liabilities |

|---|---|

| Human Capital | Fixed Expenses |

| Continuing Career | Basic Living Needs |

| Part-time work | Taxes |

| Debt Repayments | |

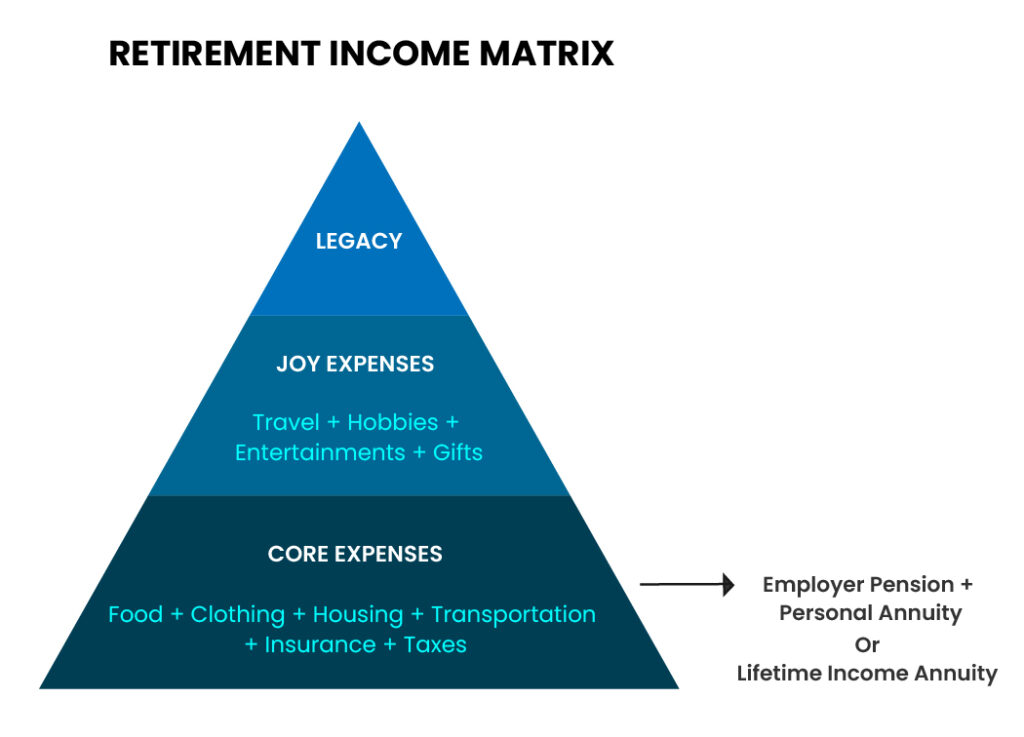

| Financial Assets | Discretionary Expenses |

| Checking Accounts | Travel & Leisure |

| Brokerage Accounts | Lifestyle Improvements |

| Retirement Plans | |

| Insurance & Annuities | Contingencies |

| Long-Term Care | |

| Health Care | |

| Other Spending Shocks | |

| Social Capital | Legacy Goals |

| Social Security | Family |

| Medicare | Community & Society |

| Company Pensions | |

| Family & Community |

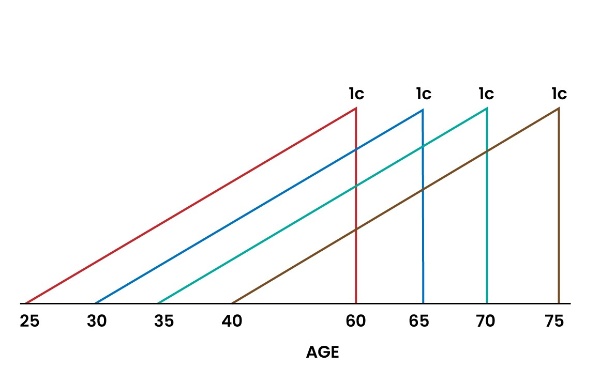

So if you are married, you really need to consider JOINT LIFE EXPECTANCY.

Do you know that you are Guaranteed about?

| Issue Age | Annual Payout Rate |

|---|---|

| 65 | 7% |

| 75 | 9% |

| 85 | 13% |

Note that these payout rates will not change

when interest change or product are re-priced

| Do banks offer different interest rates based on age? | NO |

| Post office savings? | NO |

| Tax free bonds? | NO |

| Do stocks pay higher dividend based on age? | NO |

| Mutual Fund? | NO |

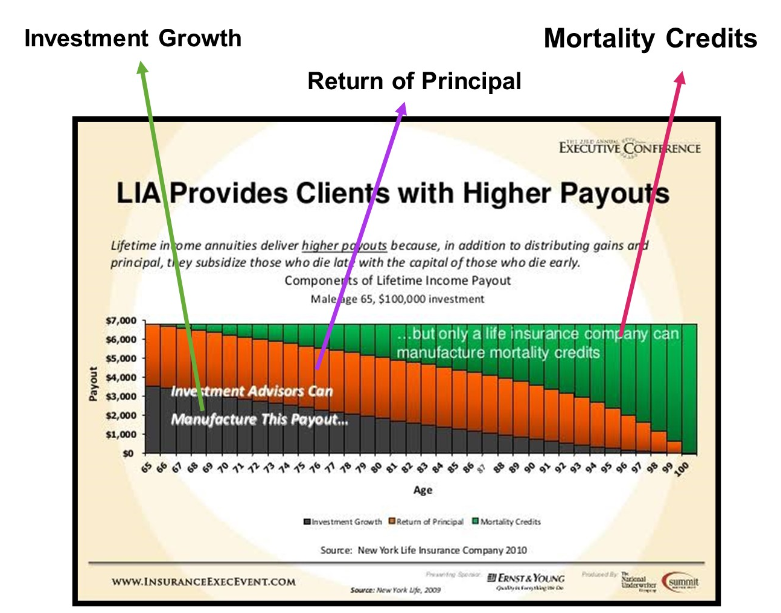

Mortality Credits = Financial Reward

They increases by longer we live. The more years we spend holding a Lifetime Annuity, the more mortality credit we will be paid.

These have nothing to do with stocks or interest rates. Instead, it is an Acturial calculation by insurance company, based on age and gender, that adds a credit from the entire risk pool of everyone who buys the same type of lifetime income annuity.

Remember, life insurance companies know when people are going to die. Now they do not know when I will die, but they know almost exactly how long people just like me will live as group.

Some people will die early and will not collect income for long, they can pay the entire pool a little more than a traditional investment.

The older we are, the longer we live and the fewer guarantees we choose, the more mortality credits we will be paid and the higher our annual income payments will be.

For that

- Joint life

- 5 to 20 years certain payments

- Return of purchased price

“The happiest people in retirement were those who had a stream of guaranteed Paychecks for life. Some had pensions. The other purchased lifetime income annuities.”

Jonathan Clements

“The secret to Happier Retirement” in WSJ.com(July 25, 2005)