Risk is Probability of Loss (Negative Variation Between Desired and Actual). Risk ignorance is not a risk management. Starting Point of Insurance is Risk Management.

Insurance is only one of the methods by which we the individuals may seek to manage their risks. Here we transfer the risks we face to an insurance company. However there are some other methods of dealing with risks. Which are

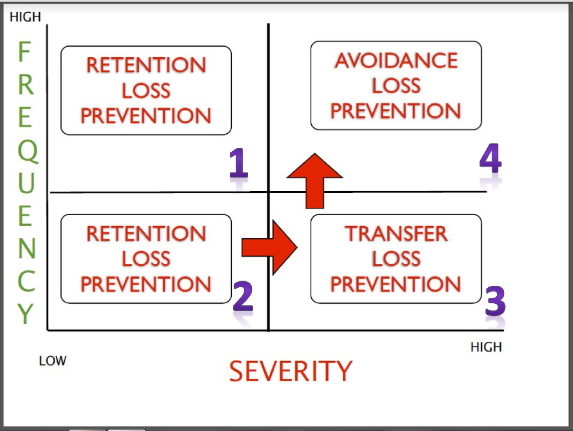

- Risk Avoidance :Controlling risks by avoiding a loss situation is known as risk avoidance. Thus we may try to avoid any property. Person or activity with which an exposure may be associated.

- Risk Retention : We try to manage the impact of risk and decide to bear the risk and its effects by ourself. This is known as self-insurance.

- Risk Reduction and Control : This is more practical and relevant approach than risk avoidance. It means taking steps to lower the chance of occurrence of a loss and/or to reduce severity of its impact if such loss should occur.

- Risk Financing :This refers to the provision of funds to meet losses that may occur.

- Risk Retention through self-financing involves self-payment for any losses as they occur. In this process we assume and finance our own risk , either through our own or borrowed funds, this is known as self-insurance.

- Risk Transfer involves transferring the responsibility for losses to another capable party. Here the losses that may arise as a result of a fortuitous event (or peril) are transferred to another entity.