Unlocking Financial Freedom: A Roadmap for Women’s Lifetime Income Success

Dr. David F. Babbel is a Professor of Insurance and Finance at the Wharton School, University of Pennsylvania, and a Senior Advisor to CRA International, an economics consulting firm. In his research paper on lifetime income for women, Dr. Babbel mentioned an experience involving a couple. Allow me to share Dr. Babbel’s account here.

At a large sporting event in Philadelphia on December 2007, a chance encounter with an engaging couple sparked a conversation that delved into the intricacies of financial planning and retirement. The woman, who had dedicated her life to raising eight children in a blended family dynamic, found herself thrust into the workforce for the first time at the age of 66.

As the conversation unfolded, it became evident that the couple’s financial stability had been upended by the transition from a defined benefit pension plan to a defined contribution 401(k) plan (in India it is NPS). Instead of the expected steady income stream, they were faced with a lump sum and the responsibility of managing their own retirement funds.

The man, having retired from a successful career, opted for a cash settlement and entrusted their savings to a promising venture managed by a family member. Unfortunately, the venture failed within two years, leaving the couple with nothing but debt and uncertainty.

With the husband’s health deteriorating and their savings depleted, the woman had no choice but to seek employment in her later years. Despite her age and the challenging economic climate, she embarked on a journey to become a real estate agent, hoping to secure their financial future amidst the crashing housing market.

Now facing the reality of working well into her 80s to support herself and her ailing husband, the woman’s resilience shines through as she confronts the harsh realities of unforeseen circumstances and financial misfortune.

Through this tale of unexpected twists and turns, one is reminded of the importance of careful financial planning and the need to prepare for the uncertainties that life may throw our way.

Today, pensions are rare; social security does not cover basic living expenses; responsibility 100 percent on us. Retirement stool comprises three legs:-

1) Pensions (rare)

2) Social Security (uncertain)

3) Personal savings (NPS, bank accounts) – this is what most people rely on to get them through retirement. Is it enough?

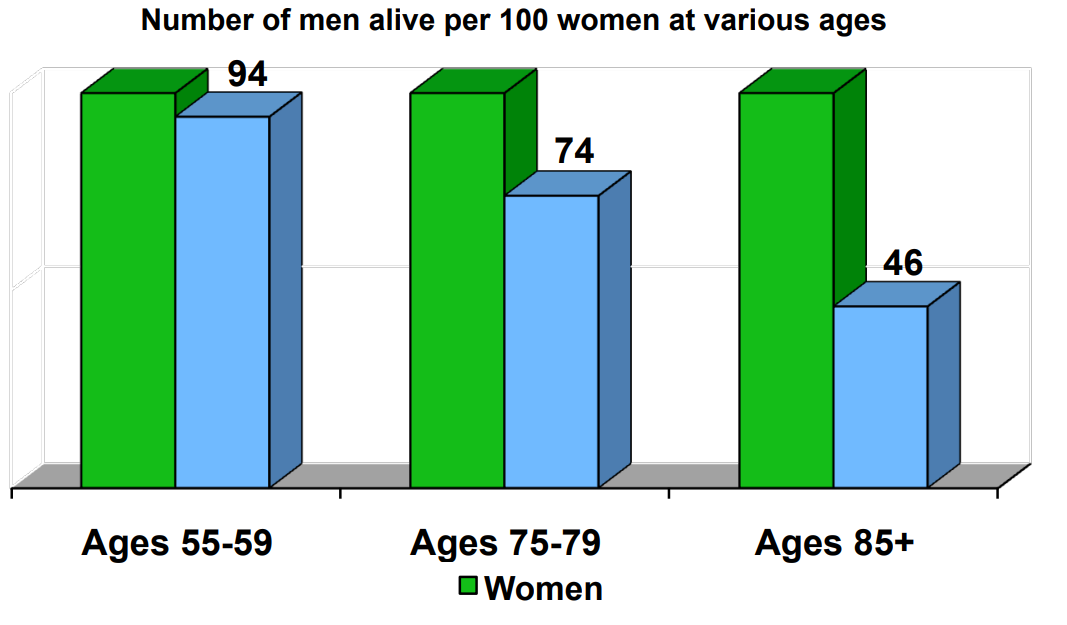

Life insurance and annuities are particularly relevant to women due to their longer average life expectancy compared to men. Moreover, women often marry men older than themselves, further extending their potential lifespan beyond that of their spouse. Consequently, women are more likely to outlive their husbands.

As a result, many women find themselves as the beneficiaries of life insurance policies, with statistics indicating that 70% or more of beneficiaries of life insurance policies are female. This places a significant emphasis on the financial stability of women who rely on life insurance payouts following the passing of their spouse.

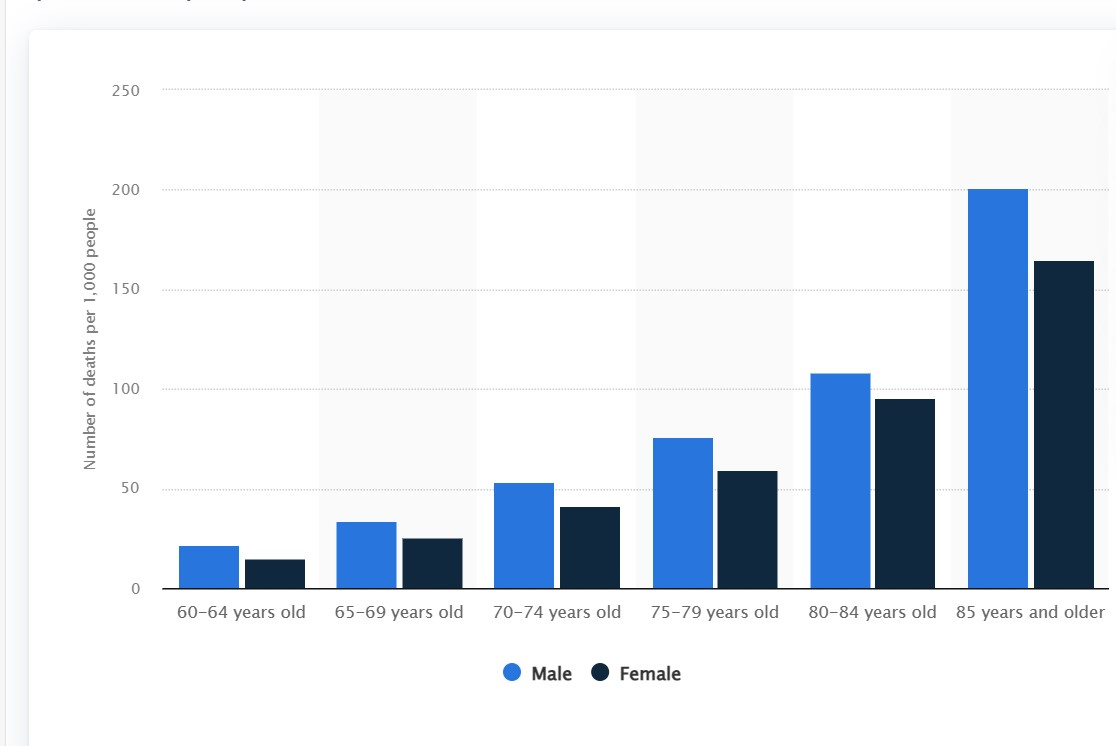

Number of Deaths Among Aging Population in India in 2020, by Gender and Age Group (Per 1000 people)

There are research and findings that underscore the importance of women to take financially prudent steps

- Older women are 50% more likely than older men to live in poverty (Bureau of Labor Statistics)

- Poverty rate for people above age 75 is 33% higher than that of people age 65-74. (Bureau of Labor Statistics)

- Approximately 44% of the elderly will ultimately require nursing home care. (Spillman and Lubitz, 2002)

- Roughly 75% of the residents of nursing homes are women. (Spillman and Lubitz, 2002)

- The majority of the residents in nursing homes are widowed, functionally dependent females. (Spillman and Lubitz, 2002)

- About 72% or the residents required help in managing money (Spillman and Lubitz, 2002)

- Women generally have much longer stayed than men in nursing homes. (Spillman and Lubitz,2002) One reason for this is that women are generally younger than their husbands and provide compassionate home care for them in their declining years, delaying the time before which they need to be cared for in a nursing home. Less than 10% of women, on the other hand, have a companion by the time their health declines, and so they seek institutional care at an earlier stage of their declining health. Ironically, in many cases the couple’s financial reserves have already been expended on the husband’s care, leaving little for the woman.

- The increasing share of retirees forgoing annuities raises the prospect of retired workers depleting their assets so that they have no resources beyond Social Security and higher poverty rates among widows. If annuities were one of the options under retirement savings plans, it could help avoid this outcome. (Johnson, Uccello and Goldwyn, 2003)

With the guidance of Institute for Social and Economic Change, Bangalore, United Nations Population Fund, New Delhi, Institute of Economic Growth, Delhi, Tata Institute of Social Sciences, Mumbai a study was done on older women in India. A paper was published as Older Women in India: Economic, Social and Health Concern.It reveals that Income insecurity is a significant source of vulnerability among older women. More than four out of five women have either no personal income at all or very little income. Economic dependency among older women is therefore high. One-third of older women do not own any assets, although more widowed women own assets compared to married women. Only a third of widowed women receive social pension. Poverty drives over ten percent of older women to work, largely in informal sectors with low wages, no retirement or post-work benefits. The accentuated economic vulnerability and poverty of older widowed women is found across all survey states.

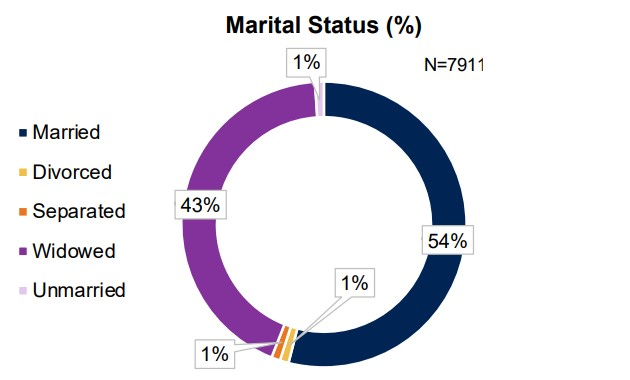

As per Longitudinal Ageing Study in India (LISA) conducted in 2021, the country’s older population is said to be the world’s second largest with nearly 140 million people being ages 60 and above. A recent study conducted by LISA for the welfare of older women, they collected sample data from a total of 7911 older women participants from across the country (greater than or equal to 60 years age). Looking at the marital status of the respondents, it is seen that a little over half of the respondents (54%) are married. Significant respondents are widowed.

A Financial Storm

Five forces are converging upon Indian today in what some have called the Perfect Storm and it is about to engulf us from all sides. The situation is particularly precarious for women and there isn’t anything we can do to stop these converging forces. The best we can do is to organize our own finances in such a way that we can provide for ourselves and our families.

-

-

- The Central Government has introduced the Defined Contribution based Pension System known as the National Pension System (NPS) replacing the system of Defined Benefit Pension with effect from January 01, 2004 vide the Ministry of Finance (Department of Economic Affairs) notification No 5/7/2003 PR dated 22/12/2003.

- Around 53% of all of the salaried workforce does not have any social security benefits in India, according to the Periodic Labour Force Survey Annual Report 2021-22. It is just 1.9% of the poorest 20% quintile of India’s workforce has access to any benefits.

- “Indira Gandhi National Old Age Pension Scheme (IGNOAPS)” is one of the five sub-schemes of the National Social Assistance Programme (NSAP). Under IGNOAPS, citizens living Below Poverty Line and 60 years or above in age are eligible to apply. A monthly pension of ₹ 200 up to 79 years and ₹ 500 thereafter.

- India will age rapidly in the coming decades. By 2050, the share of the elderly in India’s total population can reach more than 20 per cent, according to the India Ageing Report 2023 released on September 27, 2023 by the International Institute for Population Sciences and the United Nations Population Fund.

- The number of elderly will also be higher in proportion to the number of children aged 0-14 years. The number of working age people in the age group of 15-59 years will decrease. Also, women will live longer than men, due to which the number of older women will be more than older men.

- According to the report, in India, a man aged 60 years can live another 18.3 years, while women can live 19 years. Apart from this, it also depends on the different life expectancy of the states. In Kerala and Himachal Pradesh, women can be up to 4 years more than men.

Coming back to our original discussion about Lifetime Income and Women there are three broad approaches that individuals generally take (knowingly or unknowingly) when deploying their accumulated assets as they enter their retirement years. Each approach has variations.

Approach 1: Annuitize a substantial portion of their accumulated wealth.

Approach 2: Invest primarily in fixed income instruments such as bonds, money market funds, etc.

Approach 3: Invest primarily in stocks, bonds, and mutual funds

The first approach mentioned here involves securing a desired pattern of income throughout one’s lifetime by investing in an appropriate mix of annuities. Let’s break down the key points:

-

-

- Investing in Annuities for Lifetime Income Security:

-

– In this approach, retirees aim to secure a consistent pattern of income throughout their lifetime by purchasing annuities. An annuity is a financial product that provides regular payments to the holder for a specified period, often until death.

– By investing in annuities, retirees can ensure a steady stream of income regardless of how long they live. This eliminates the risk of outliving their savings, as the annuity payments continue until the end of life.

– It is essential to choose an appropriate mix of annuities to meet individual financial needs and goals. This may involve selecting between fixed annuities (providing a guaranteed income) and market linked annuities (with payments linked to investment performance).

-

-

- Emergency Fund and Additional Investments:

-

– Retirees following this approach should also set aside funds for emergencies to cover unexpected expenses that may arise during retirement. This ensures financial stability and reduces reliance on the annuity income for unplanned costs.

– After securing income through annuities and establishing an emergency fund, retirees may choose to invest any remaining funds in stocks, bonds, or other investments to potentially generate additional income or growth.

-

-

- No Reduction in Heirs’ Inheritance:

-

– One significant advantage of this approach is that the amounts received by heirs are not reduced if the retiree lives longer than expected. Unlike other approaches where heirs may receive less if the retiree outlives their assets, the annuity payments continue until the retiree’s death, providing a consistent inheritance for heirs.

Overall, this approach provides retirees with a reliable source of income throughout retirement, mitigating the risk of outliving savings and ensuring financial security for both the retiree and their heirs.

The second approach mentioned here involves variations in how retirees can structure their income during retirement. Let’s break down each variation:

-

-

- Variation 1: Creating a Desired Pattern of Income with the help of Skillful Investment advisor:

-

– In this variation, retirees aim to generate a consistent pattern of income throughout their lifetime, similar to what they might achieve through annuitization (a process of converting a sum of money into a series of periodic payments). However, achieving this level of income security through investments typically requires 25% to 40% more capital compared to annuitization.

– The risk with this approach is that there’s a chance the income may expire before the individual passes away, especially depending on how interest rates evolve over time. This means there’s a possibility of outliving the income stream.

– Additionally, retirees need to set aside funds for emergencies and may want to give money away while still alive, which further increases the required capital. If retirees don’t allocate enough funds, they run the risk of depleting their assets before the end of their life, leaving less for their heirs.

– The heirs become the residual claimants in this scenario, meaning they receive whatever remains after the retiree’s expenses and potential financial emergencies. The longer the retiree lives and requires financial support, the less will be left for the heirs.

-

-

- Variation 2: Investing in Fixed Income Instruments with Reduced Monthly Consumption:

-

– In this variation, retirees can invest in a portfolio of fixed income instruments that are expertly designed to mimic the income stream they would have received through annuitization. However, they choose to consume 25% to 40% less each month compared to what they would have received through annuitization.

– By reducing monthly consumption, retirees aim to stretch their assets further and mitigate the risk of running out of money prematurely. However, there’s still a risk of failure if unexpected expenses arise, or if interest rates move unfavorably during the retiree’s lifetime.

– Again, the heirs become the residual claimants, bearing the financial risks associated with the retiree’s chosen strategy. They may receive less if the retiree’s assets are depleted sooner than expected.

Both variations involve trade-offs between income security, desired lifestyle, and the potential needs of heirs. Retirees must carefully consider their financial goals, risk tolerance, and longevity expectations when deciding which approach to adopt. Additionally, consulting with a skilled investment advisor can help retirees navigate these complexities and make informed decisions tailored to their individual circumstances.

The third approach to retirement involves putting all of our wealth into stocks, bonds, mutual funds, or similar investments. This approach offers the most flexibility and potential for high returns, but it also carries the highest risk and provides the least financial security.

Here’s a breakdown of the key points:

-

-

- Flexibility and Potential Returns:

-

– By investing all our money in these types of investments, we have the most freedom to use our funds as we wish. We can easily access our money whenever we need it, and there’s a chance of earning high returns on our investments, which could lead to substantial wealth growth over time.

-

-

- High Risk and Less Security:

-

– However, this approach comes with significant risks. If the stock or bond markets don’t perform well, you might end up losing a large portion of our wealth. There’s also the temptation to spend too much or be approached by others who know you have money available, potentially leading to financial troubles.

– If our investments don’t perform as expected, we might run out of money during retirement and have to rely solely on Social Security, help from relatives, or even charity to make ends meet.

-

-

- Flawed Logic About Risk-Taking:

-

– Some people have been attracted to this approach because they believe that women, who generally live longer than men, need to take more financial risk to accumulate enough wealth for retirement.

– However, recent studies have questioned this idea. They suggest that when there’s uncertainty about future investment returns, as there often is, it’s actually wiser for retirees to have fewer investments in stocks and take on less risk.

– These studies also indicate that many investors, including professional money managers, often don’t perform as well as the stock market itself, despite advice to take on more risk.

In simpler terms, the third approach involves investing everything in the hope of high returns, but it’s the riskiest option and could leave you in a difficult financial situation if things don’t go as planned.

Longevity Risk and women:

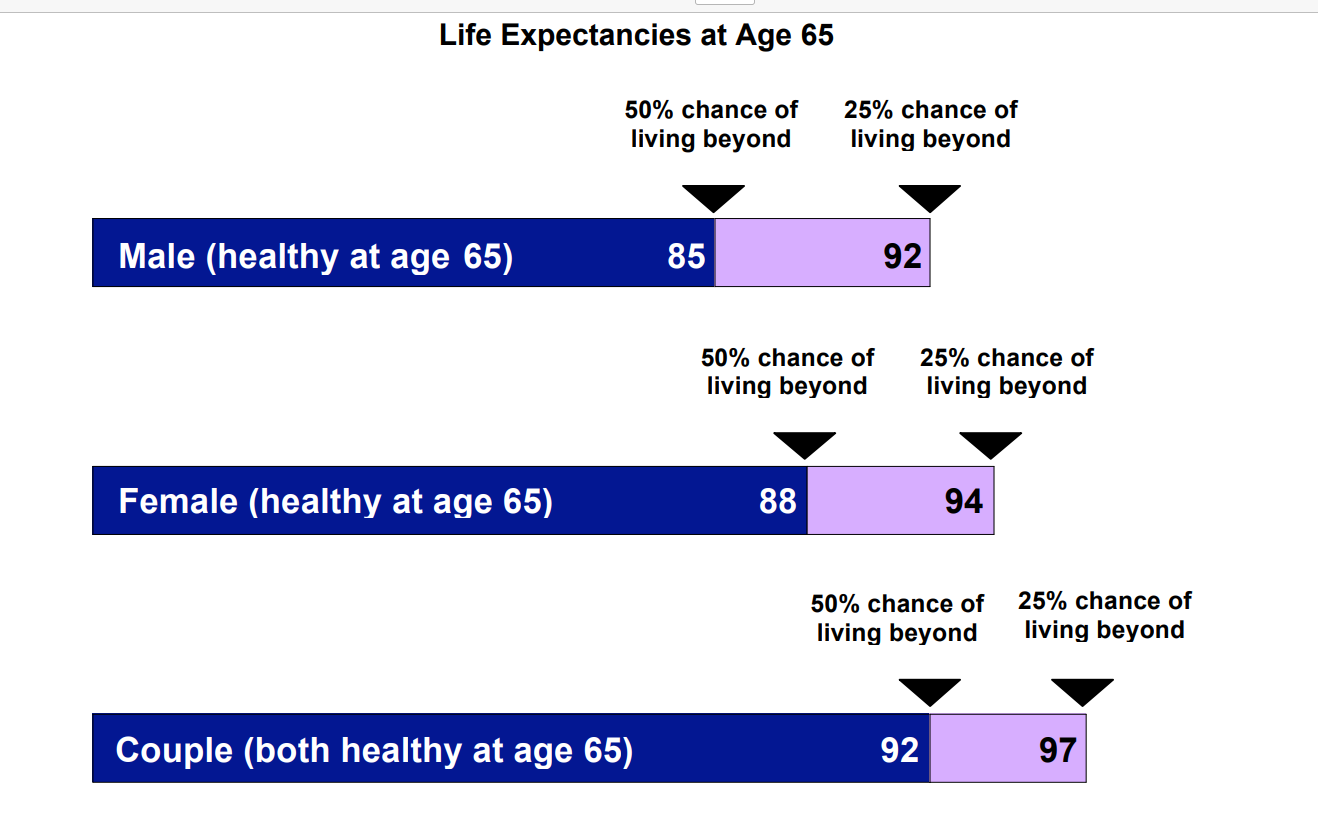

People are living longer than ever before. The average 60-year-old male will live to age 78, while the average 60-year female will live to 82. But what is the problem with averages is that they have nothing to do with how long any one individual will live. Half of the reader of this article will live longer than their gender’s average life expectancy. Life expectancy is not an average at all. It is simply a mid-point. Half of all 60-year-old men will die prior to age 78. What about the other half? But whole other half will remain alive beyond age 78. Half of the 60-year-old female will die prior to age 82, but half of them will alive beyond 82 ages. Therefore, averages are not indicator of how long our retirement will last rather we must prepare well to operate under the notion that we very well may live long past our gender’s average age of death.

Source: Annuity 2000 Mortality Table, appeared in Scott DeMonte and Lawrence Petron, “income Annuities Improve Portfolio Outcomes in Retirement,” Financial Research Corporation report,2010.Risk Tolerance:

There is a body of recent research indicating a consistent trend: males tend to exhibit a higher tolerance for risk compared to females. These findings stem from various methodologies, including observed behaviors, experimental setups, and survey responses. Yao and Hanna (2005) succinctly summarize the main conclusions:

– Men are less inclined than women to opt for annuitizing their wealth upon retirement, all else being equal.

– Males demonstrate a greater inclination towards placing their investments in riskier assets.

– Married women, who typically outlive their spouses by approximately six years, may face the repercussions of these choices unless they actively participate in financial decision-making.

– Besides gender, other factors influencing an individual’s risk tolerance include wealth, income, financial literacy, knowledge, race, and proximity to retirement.

– Analysis of risk tolerance distribution indicates that, even when controlling for demographic and economic variables, unmarried males exhibit the highest propensity for assuming high financial risk, followed by married males, and then unmarried females. Married females exhibit the lowest likelihood of embracing high-risk financial strategies.

– These differences in risk tolerance are statistically significant. Unmarried males are 1.4 times more likely than married males to embrace high financial risk, and twice as likely as unmarried females in similar circumstances. Similarly, married males are 1.7 times more inclined towards high financial risk compared to married females of comparable profiles.

– Women demonstrate a higher tendency than men to invest in risk-averse securities like bank certificates of deposit (CDs) and US Treasury securities, indicating a lower risk tolerance among women (Embrey and Fox, 1997).

– Single women exhibit a lower inclination towards investing in stocks and a higher preference for bonds compared to married females, married males, and single males (Christiansen et al., 2006).

– Men are more inclined to allocate their assets predominantly to stocks, suggesting a greater appetite for financial risk (Sundén and Surette, 1998).

Why Do Lifetime Income Annuities Yield So Much?

Let us imagine that we take out a home loan of ₹10,00,000 at an interest rate of 6% per year, compounded monthly, to buy a house. With a traditional mortgage, we would make monthly payments that cover both the interest on the loan and a portion of the principal (the original amount borrowed).

Now, let us compare this to an annuity. Instead of borrowing money, I invest ₹10,00,000 into an annuity. The annuity pays me back a fixed amount each month for a certain period, typically for the rest of my life. Each monthly payment I receive from the annuity includes both interests earned on my investment and a portion of the original amount I invested.

Here’s the key difference: with the mortgage, I am paying money out each month to cover both interest and principal. But with the annuity, I am receiving money each month that includes interest earned on my investment and a return of a portion of my original investment.

Because of this return of principal, the monthly payments I receive from the annuity are typically higher than what I could earn from other low-risk investments like fixed deposits, bonds, or money market funds. In fact, over time, the payments from an annuity can even exceed what I might earn from riskier investments like stocks.

So, in simple terms, annuities provide a steady stream of income that includes both interest and a return of our initial investment, making them a reliable option for generating income in retirement.

Conclusion

Although the views expressed in this article are personal, they echo sentiments shared by leading economists worldwide regarding the significance of lifetime income annuities in retirement planning. With the widespread disappearance of defined benefit pensions, the choice to annuitize has become increasingly crucial.

Despite this acknowledgment, lifetime income annuities are often overlooked in the investment options available for retirement plans, both during the accumulation phase leading up to retirement and in the subsequent decumulation phase. Instead, retirement plan menus typically feature a plethora of mutual fund offerings that may not adequately address the primary risk of retirement: the possibility of outliving one’s assets.

As a result, individuals seeking investments that can provide a steady stream of income throughout retirement may need to proactively explore options offered by life insurance companies. This may involve some diligent searching, but it’s a vital step in ensuring financial security during one’s later years.

As we plan for retirement in India, let’s cherish the third leg of our financial stool. It’s not just about hoarding wealth; it’s about embracing financial freedom. Retirement marks the beginning of a life unshackled by monetary worries, where every rupee is a stepping stone to our dreams and self-actualization. Let’s weave our plans with care, for in the tapestry of retirement lies the promise of a life truly lived. Happy hunting for the right solution!

Nayan Bhowmick

SBA, LIC, Shillong

-